Governance

Development and Operation of a Process that Ensures Highly Workable Governance

TOKYU REIT and Tokyu REIM regard excellent governance as a source of competitiveness and a factor that contributes to the enhancement of unitholder value. TOKYU REIT implements steady operations pressing ahead with designing and developing governance that is fully satisfactory in terms of global standards as well so that investment securities issued by TOKYU REIT will be sought after by all types of investors both in Japan and abroad as global products.

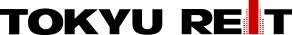

◆Governance Structure(TOKYU REIT)

- TOKYU REIT’s Governance Structure

- Appointment of Directors

Candidate directors were appointed via a resolution of the General Meeting of Unitholders for the reasons indicated below, with the requirement that they do not meet any of the reasons for disqualification stipulated in various laws such as the Act on Investment Trusts and Investment Corporations.

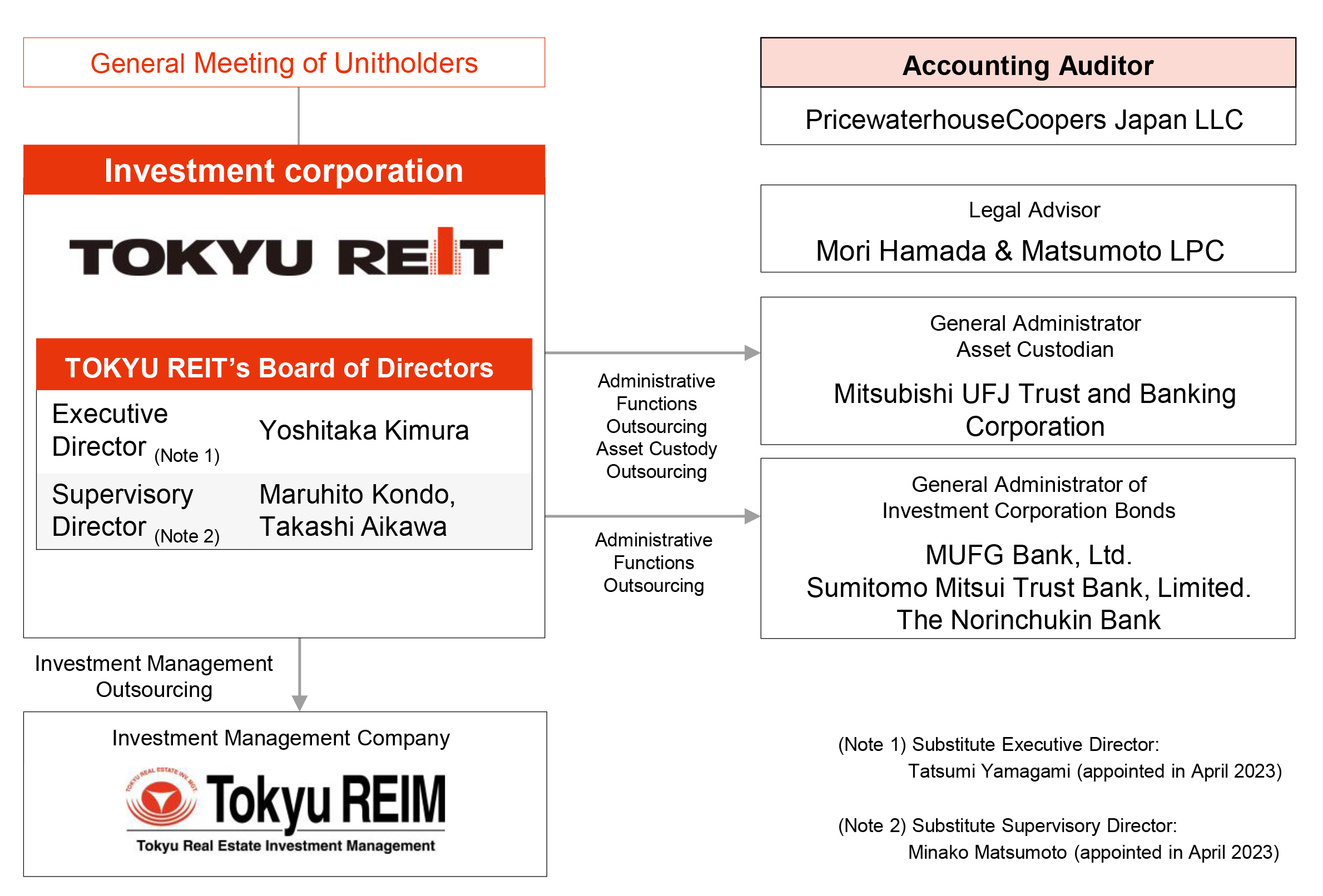

<Reasons for Appointment and Attendance at Board of Directors Meetings>

|

Title |

Name |

Reason for Appointment |

Attendance at Board of |

|

|

FP ended |

FP ended |

|||

|

Executive |

Yoshitaka Kimura |

He may be expected to possess excellent executive skills as the executive director of TOKYU REIT due to extensive practical experience and knowledge relating to corporate management and business strategy, as well as extensive knowledge gained as a manager involved in managing a subsidiary of Tokyu Corporation, etc. As President and CEO of Tokyu REIM, he is also well-qualified in light of his objective, which is to ensure close collaboration between TOKYU REIT and Tokyu REIM. |

― |

100% |

|

Supervisory |

Maruhito Kondo |

Possessing knowledge and experience as a legal professional as well as extensive knowledge as a manager involved in managing a law firm, along with ample experience as an outside director, he may be expected to supervise execution of the executive director’s duties from a broad perspective. |

100% |

100% |

|

Supervisory |

Takashi Aikawa |

Possessing knowledge and experience as an accounting professional as well as extensive knowledge as a manager involved in managing an auditing firm, along with ample experience as an outside director, he may be expected to supervise execution of the executive director’s duties from a broad perspective. |

100% |

100% |

(Note)Indicates attendance record since appointment in May 2023.

Please refer to this page, about the Career Summary of currently appointed Directors.

<Skills Matrix of Directors>

|

Title |

Name |

Corporate |

Real Estate |

Finance & |

Auditing & |

Legal & |

|

Executive |

Yoshitaka Kimura |

〇 |

〇 |

〇 |

||

|

Supervisory |

Maruhito Kondo |

〇 |

〇 |

〇 |

||

|

Supervisory |

Takashi Aikawa |

〇 |

〇 |

〇 |

*The table does not show all officers’ expertise and experience but rather the areas among the representative skills in which they possess comparatively exceptional abilities.

◆Remuneration for Directors

Remuneration is determined by the Board of Directors, with the upper limits for Directors remuneration (executive director: 1 million yen per month per person, supervisory directors: 800,000 yen per month per person) stipulated in TOKYU REIT’s Articles of Incorporation.

<Status of Remuneration for Directors>

|

Title |

Name |

Main Other Positions |

Total Remuneration |

|

|

FP ended |

FP ended |

|||

|

Executive |

Yoshitaka Kimura |

Also holds the position of representative director and president, CEO of Tokyu Real Estate Investment Management Inc. |

― |

― |

|

Supervisory |

Maruhito Kondo |

Also holds the positions of representative partner at Maruhito Kondo Law Office, etc. |

3 million yen |

3 million yen |

|

Supervisory |

Takashi Aikawa |

Also holds the positions of chief representative at Shinsoh Audit Corporation and outside auditor at SHOEI FOODS CORPORATION. |

3 million yen |

3 million yen |

*The executive director and supervisory directors do not own any TOKYU REIT investment units, either in their own name or another party’s name. Moreover, the supervisory directors may serve as directors for corporations other than those indicated above, but they have no interest in TOKYU REIT, including the above.

(Note)The executive director is not paid remuneration for serving as TOKYU REIT’s executive director.

◆Remuneration for Accounting Auditor

Remuneration for the accounting auditor is determined by the Board of Directors, with an upper limit of 15 million yen per fiscal period stipulated in TOKYU REIT’s Articles of Incorporation.

|

Name |

Total Remuneration |

|

|

FP ended Jan. 2023 |

FP ended Jul. 2023 |

|

|

PricewaterhouseCoopers Japan LLC |

14 million yen |

10 million yen |

(Note 1) PricewaterhouseCoopers Aarata LLC changed its name to PricewaterhouseCoopers Japan LLC on December 1, 2023.

(Note 2) Indicates the amount including remuneration for the work of preparing a comfort letter relating to the issuance of investment corporation bonds.

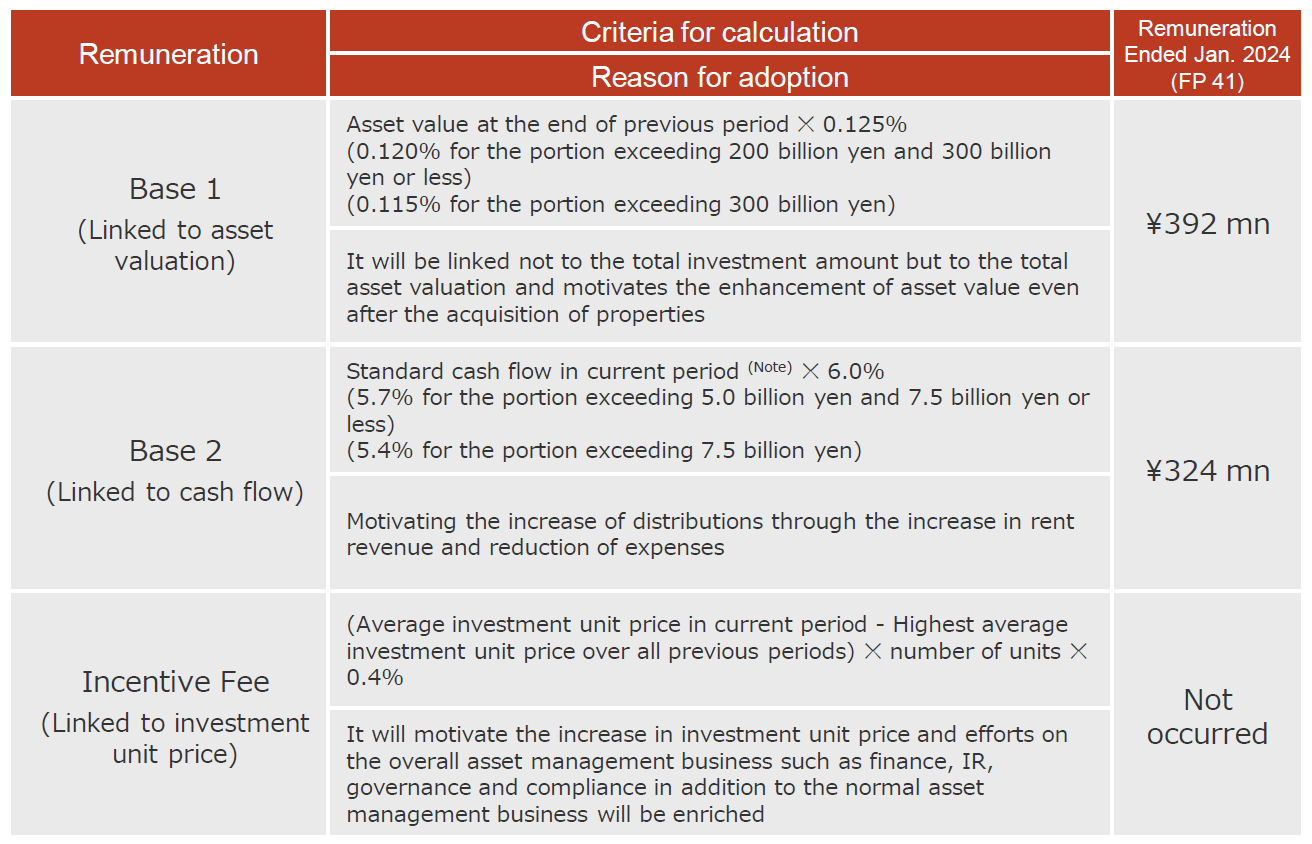

◆Remuneration for Tokyu REIM

Remuneration for Tokyu REIM comprises base 1 remuneration, base 2 remuneration, and incentive fees, based on TOKYU REIT’s Articles of Incorporation.

Please refer to this page, about details of Tokyu REIM’s remuneration.

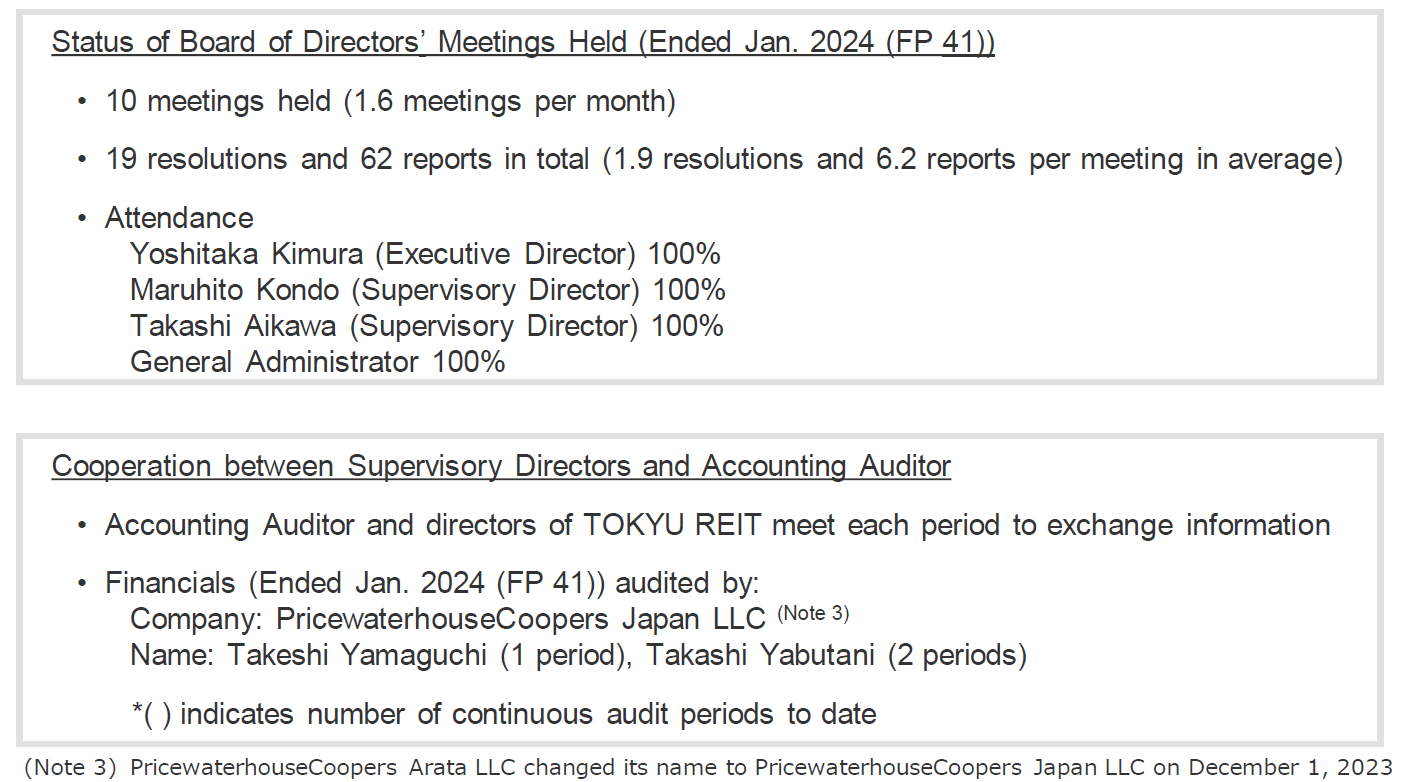

◆Governance Structure (Tokyu REIM)

| Board of Directors | The Board of Directors consists of 2 representative directors (the President and Chief Executive Officer (CEO) and Executive Vice President), 3 full-time directors and 2 part-time directors to ensure oversight of business execution. |

|

Compliance and Risk Management Committee |

The Compliance and Risk Management Committee is an advisory body to the Board of Directors that consists of 2 part-time directors of Tokyu REIM and 2 external committee members. It meets at the request of the Board of Directors to discuss important compliance and risk management matters (including matters related to individual transactions with interested parties and matters deemed necessary by the Executive Officer in charge of compliance or the Executive Director of the committee). It also deliberates on the appropriateness of interested-party transaction regulations and reports to the Board of Directors. |

|

Investment Committee |

The Investment Committee is an advisory body to the Board of Directors that consists of Representative Director and President (committee chairman) of Tokyu REIM, Representative Director and Executive Vice President, 3 directors and a professional member qualified as a real estate appraiser. It meets at the request of the Board of Directors to deliberate on and resolve the formulation and revision of the Management Guidelines and Asset Management Plan, the asset allocation for the entire portfolio and investment decisions for individual properties, and reports to the Board of Directors. |

| Disclosure Committee | The Disclosure Committee consists of General Manager, Finance and IR (committee chairman), General Administration, Compliance Office and Business Planning & Development. Of the information subject to timely disclosure, the committee deliberates on disclosure of facts concerning TOKYU REIT, Tokyu REIM and TOKYU REIT's portfolio, and submits the results to the President and CEO. In principle, such disclosures are made with the approval of the President and CEO. |

|

Sustainability Promotion Committee |

The Sustainability Promotion Committee consists of Chief Sustainability Manager (Chief Financial Officer) (committee chairman), full-time directors, executive officers and the heads of each division. Progress and achievement related to matters discussed and reviewed by the committee are regularly reported to the Board of Directors and TOKYU REIT's Board of Directors. |

| President and CEO | The President and CEO is the chief executive officer of Tokyu REIM as well as the chief compliance and risk management officer. |

| Auditors | Tokyu REIM has appointed 2 auditors (part-time). It has also established a statutory auditors' secretariat to ensure that their audits are conducted effectively. In principle, the Auditors attend meetings of the Board of Directors, the Compliance and Risk Management Committee and Investment Committee, and conduct audits focusing on the legality of business execution. They also try to enhance the effectiveness of accounting and business audits by working with the Accounting Auditor and Compliance Office, which conducts internal audits, through the statutory auditors' secretariat. |

| Accounting Auditor | Tokyu REIM has voluntarily chosen to be a company with an Accounting Auditor in accordance with the Companies Act (Act No. 86 of 2005, as amended) and works to ensure the reliability of its financial statements by having its accounts audited by a different auditing firm than TOKYU REIT's Accounting Auditor. In addition, it actively provides information necessary for audits through regular meetings between the Accounting Auditor and representative directors and such. |

※Advantages and Disadvantages of Concurrent Positions

The President of Tokyu REIM concurrently holds the position of Executive Director of TOKYU REIT after notifying the Commissioner of the Financial Services Agency on May 11, 2023, in accordance with Article 31-4, Paragraph 1 of the Financial Instruments and Exchange Act. This concurrent position allows for faster and more specific reporting to TOKYU REIT's Board of Directors, a benefit TOKYU REIT takes full advantage of to eliminate the information gap between the Executive Director and contracted parties such as general administrators, asset custodians, lead managing underwriters, property management companies, etc. We are focused on maximizing TOKYU REIT’s Board of Directors’ monitoring of compliance and achieving a high level of quality in this area.

In addition, TOKYU REIT and Tokyu REIM have established an office space, filing system, email address, etc. exclusive for TOKYU REIT's Executive Director separate from the position of President of Tokyu REIM and implemented an approval process as TOKYU REIT's Executive Director, ensuring a system that monitors Tokyu REIM's business processes in order to avoid confusion of responsibilities for executing business.

Although there are possible disadvantages to having the President of Tokyu REIM concurrently serve as TOKYU REIT's Executive Director, such as risks arising from a conflict of interest between the two companies or a decline in monitoring due to an increased workload, TOKYU REIT works to mitigate risks and reduce the burden on those holding concurrent positions by strengthening supervision of executive directors and Tokyu REIM by supervisory directors, while Tokyu REIM conducts fair business operations in accordance with its self-imposed rules on related-party transactions and enhances and delegates authority to officers and employees supporting Tokyu REIM President.

※Management System for TOKYU REIT's Contracted Parties

TOKYU REIT's Board of Directors receives regular business reports and explanations from general administrators and asset custodians regarding the status of general administration and investigates as necessary. It also maintains broad supervision of asset management by requesting detailed explanations and reports from Tokyu REIM.

◆Internal Control

- Resolution on “Basic Policy on Development and Operation of Internal Control System”

Given that Tokyu REIM is a company entrusted with asset management for a publicly listed real estate investment trust, the Board of Directors voluntarily resolved that matters stipulated in Article 362-4-6 of the Companies Act shall be its “Basic Policy on Development and Operation of an Internal Control System.”

- Establishment of “Internal Control Policy”

Tokyu REIM has created an “Internal Control Policy” for business operations, and by clarifying basic policies for actual practices, it seeks to enhance the efficiency and efficacy of tasks, the credibility of financial reporting, and compliance with laws and regulations associated with business activities, as well as establish and strengthen an internal control system relating to asset protection.

- Internal Control Evaluation by the Sponsor

As part of internal control relating to Tokyu Corporation’s financial reporting, each year, Tokyu REIM is evaluated by Tokyu Corporation with respect to the development and operation of internal control.

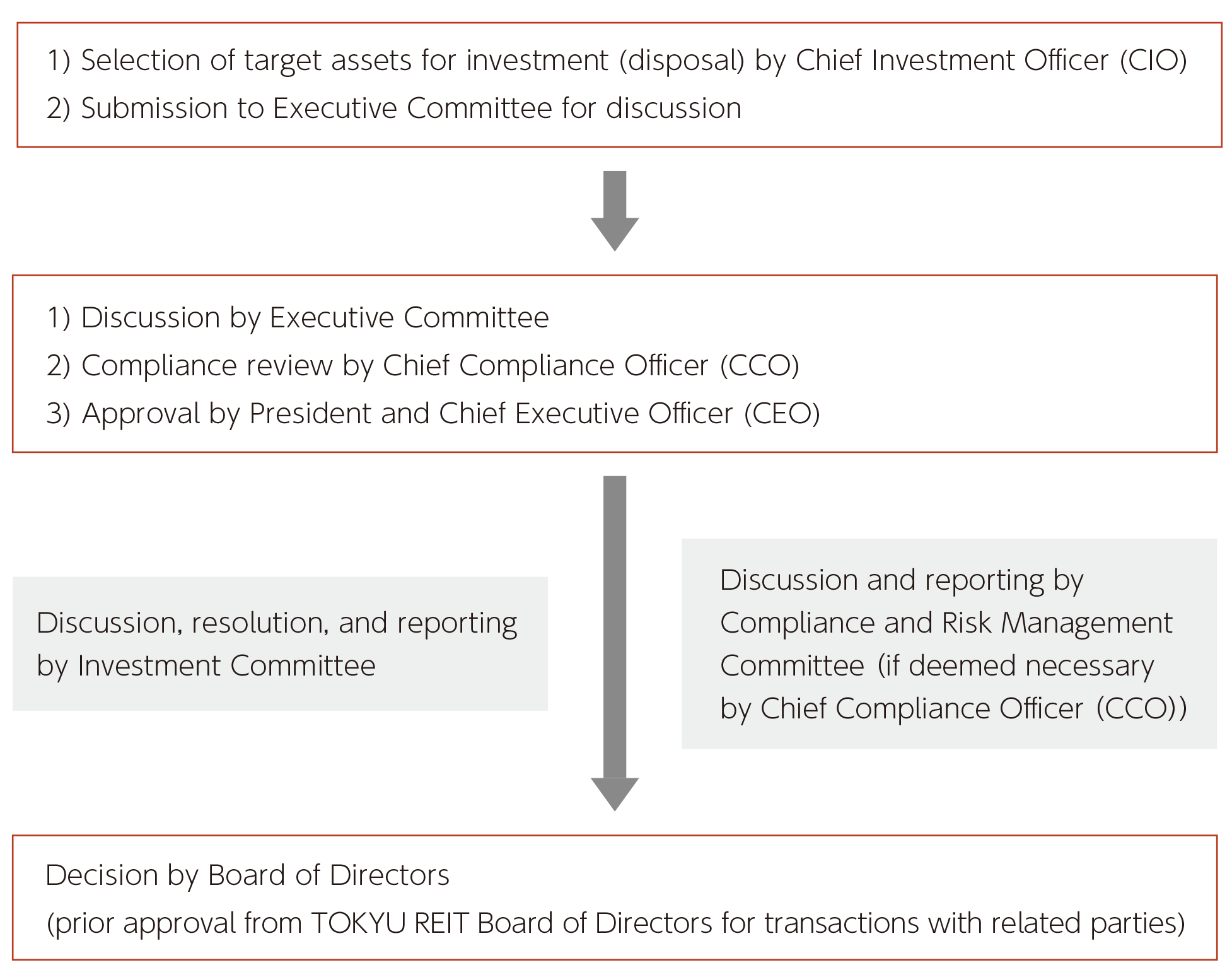

◆Decision-Making Process

For the purpose of achieving a highly efficient and transparent management structure, Tokyu REIM has developed “Management Guidelines” that stipulate necessary matters relating to asset management and capital management and various regulations such as the “Rules on Related-Party Transactions,” which comprise basic rules and specific rules, as voluntary asset management company rules, and it has established an appropriate decision-making process based on these.

When acquiring or disposing of properties, the executive officer responsible for asset development and asset management, who is the Chief Investment Officer (CIO), selects the target asset and submits it to the executive committee for discussion. Then, following review by the executive officer responsible for compliance, who is the Chief Compliance Officer (CCO), and approval by the President and CEO, it is discussed by the Board of Directors. The Board of Directors may discuss the matter in advance with the Investment Committee (decision-making body) and Compliance and Risk Management Committee (discussion body), which serve as advisory bodies. The decision to acquire (dispose of) the property is then made by resolving to approve the proposal while respecting the endorsement, discussion, and findings of each advisory body, as well as any minority opinion report or written opinion submitted by a member of either committee. The details are reported to the TOKYU REIT Board of Directors. For transactions with related parties, discussion by the Compliance and Risk Management Committee and advance approval by TOKYU REIT’s Board of Directors is required.

<Decision-Making Process When Acquiring or Disposing of Properties>

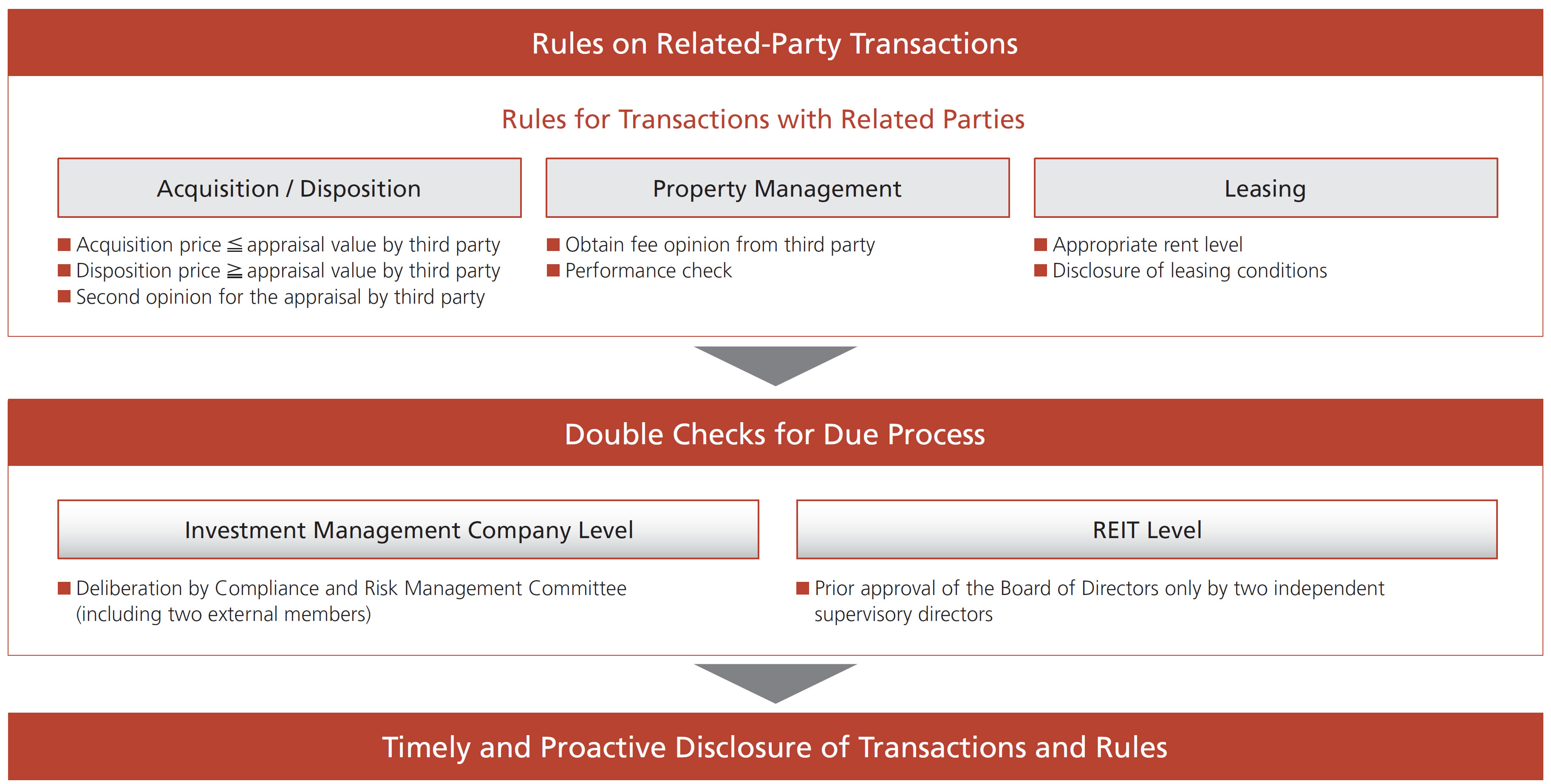

◆Measures Against Conflict of Interest

Tokyu REIM has stipulated “Rules on Related-Party Transactions,” which comprise basic rules and specific rules, as voluntary rules, and takes measures to prevent conflicts of interest in transactions with related parties.

*Please refer to this page, about Related Parties

◆Investment Management Fee

Investment management fee structure linked to three performance indices aimed to balance conflicts of interest by “being in the same boat as unitholders.”

(Note) Standard cash flow here shall be the amount derived by subtracting an amount equivalent to 50% each of profit or loss from the sale of specified assets and profit or loss from the valuation of specified assets from the net income before income taxes, plus depreciation and amortization of deferred assets.

*The above fees are all booked as expenses. TOKYU REIT does not adopt an acquisition incentive fee, which is capitalized on the balance sheet.

*Apart from the above, TOKYU REIT pays predetermined fees, etc. to an asset custodian, general administrators, PM companies and an independent auditor, among others.

◆Internal Audits

Tokyu REIM examines whether the company's operations are being conducted appropriately and efficiently in accordance with laws, regulations and internal rules, reports the results to the Board of Directors and the President and CEO and makes recommendations for improvement to the divisions subject to internal audits. In addition, for matters that have been pointed out to each division in internal audits, Tokyu REIM conducts a follow-up audit to understand the progress in such responses as well as reflect them on the internal audit plan for the next fiscal year. Internal audits cover all organizations, divisions and operations, and in cases where some operations are outsourced to outside parties, the status of management by the outsourcing divisions is also included.

| <Major internal audit items> (1)Status of internal control systems (2)Status of compliance systems, including prevention of complaints, accidents, fraud and violations of laws, regulations and Tokyu REIM's internal rules (Tokyu REIM Code of Conduct, etc.), as well as detection and handling after detection (3)Status of risk management systems, including prevention of risks in business and operations and measures to deal with risks when they materialize (4)Status of information security systems, including assurance of effectiveness, efficiency, reliability, compliance and safety in information management, such as personal information management and system management, as well as handling of incidents and failures, including loss, leakage, falsification, destruction and unauthorized access (5)Other necessary matters |

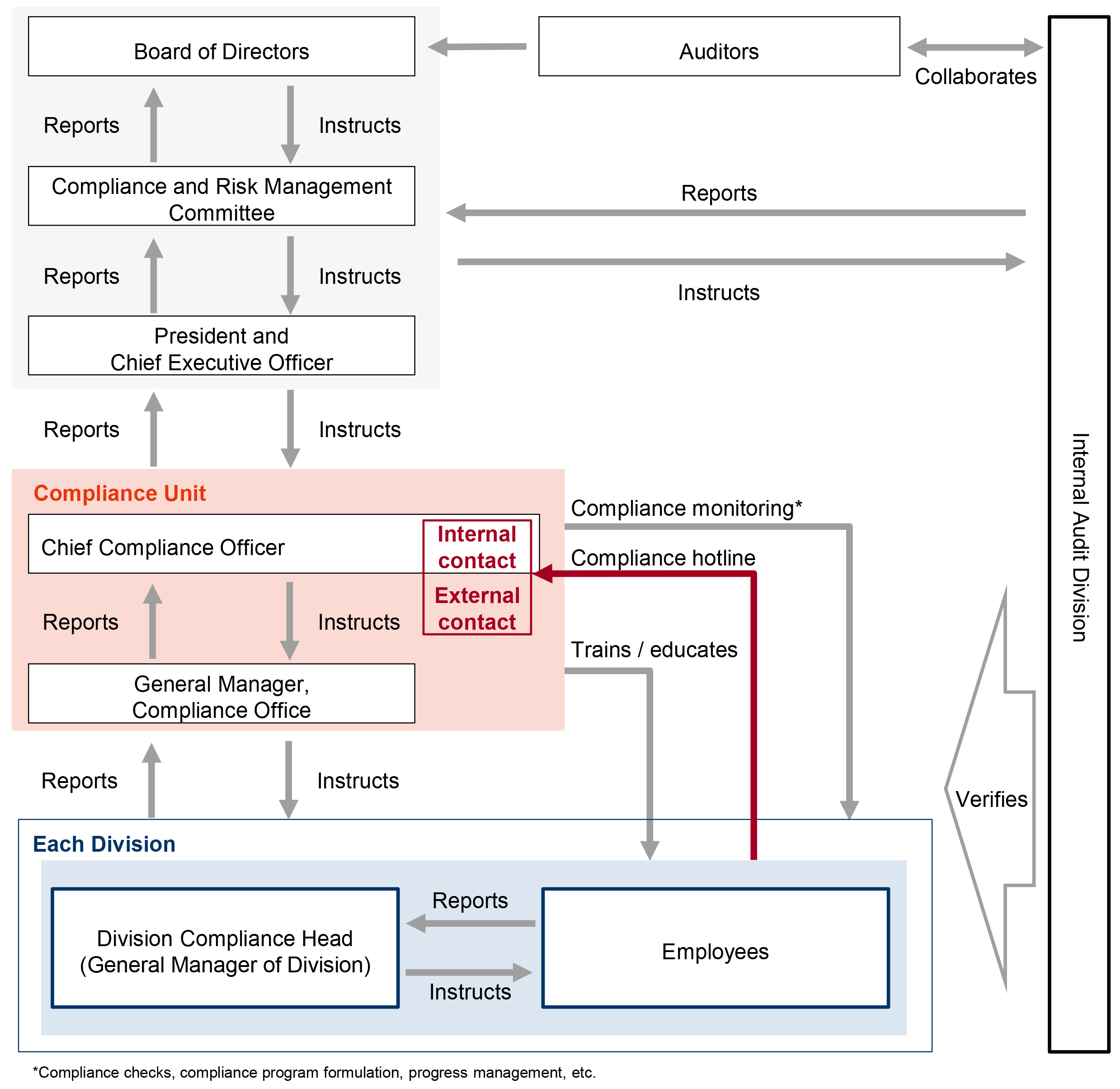

Promotion of Compliance and Risk Management

◆Compliance

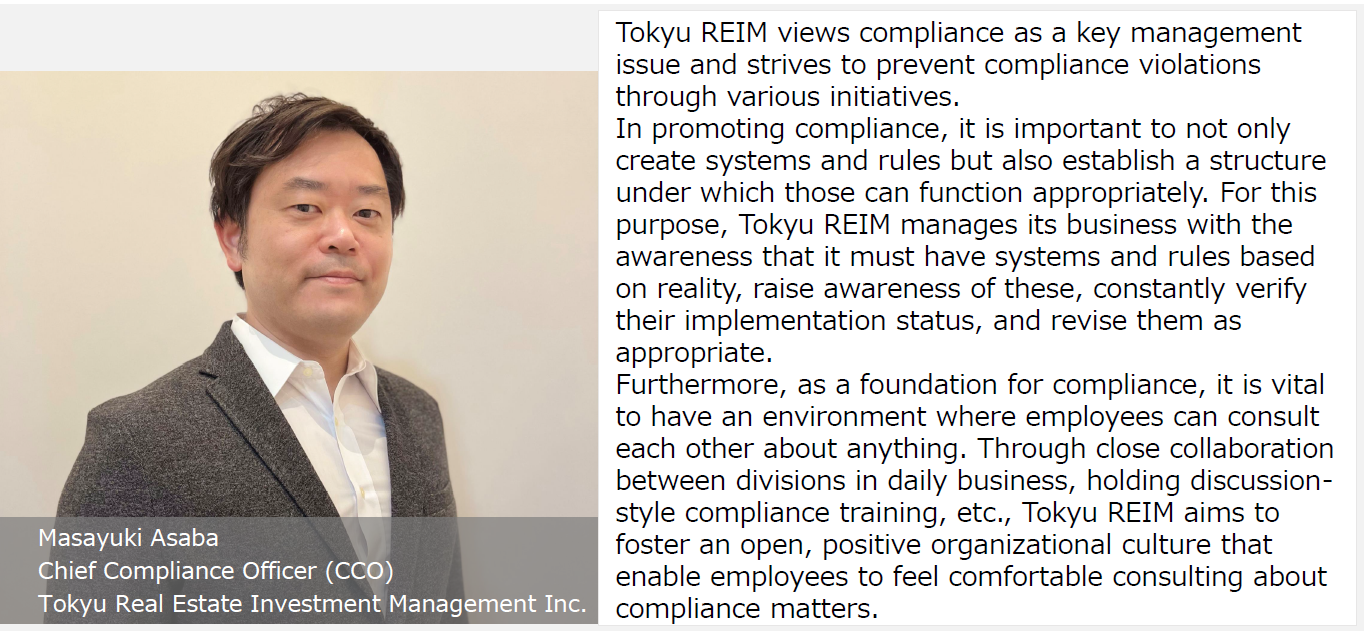

- Approach to Compliance

<TOKYU REIT>

Recognizing its social responsibility and pubic mission as a listed real estate investment trust corporation, TOKYU REIT has established its own “Compliance Policy” and designs and develops governance with the aim of securing the confidence of investors and other stakeholders through compliance with ethics, laws and regulations, market rules (including global regulations applicable to TOKYU REIT), guidelines of the competent authorities, internal rules of TOKYU REIT, etc., in other words, thorough implementation of compliance.

<Tokyu REIM>

Tokyu REIM has established “Tokyu REIM Code of Conduct,” “Basic Policy for Compliance,” “Compliance Rules,” “Tokyu REIM Compliance Manual,” “Compliance Program” and other internal rules, and implements thorough compliance of ethics, laws and regulations, market rules (including global regulations applicable to Tokyu REIM), etc., particularly focusing on proper management of information on corporations and personal information, securement of credibility on disclosure of financial reports and such.

- Compliance Standards

・Chief Compliance Officer (CCO)

The Chief Compliance Officer (CCO) oversees compliance operations, as well as managing the compliance consultation desk, etc. Furthermore, based on the “Compliance and Risk Management Committee Regulations,” the CCO ensures that important matters related to compliance and risk management (including matters related to individual transactions with related parties and matters deemed necessary by the executive officer in charge of compliance or the the executive director of the committee) and matters related to the validity of the details stipulated by the Rules on Related-Party Transactions are brought before the Compliance and Risk Management Committee in an appropriate manner.

・Compliance Program

Each fiscal year, a compliance program is created as a practical plan relating to compliance, and based on this program, various compliance-related measures are implemented. Furthermore, the status of the program’s execution and achievement is checked on a regular basis, and if revising the details is necessary, they will be revised as appropriate.

・Tokyu REIM Compliance Manual

To enhance officer and employee understanding of the basic approach to executing duties and of the relevant laws, regulations, internal rules, etc. that should be followed, the company has created the “Tokyu REIM Compliance Manual” as a handbook for fostering awareness among all officers and employees. The aim is for the knowledge and awareness acquired through this manual to help prevent compliance violations by officers and employees and further enhance the approach to compliance.

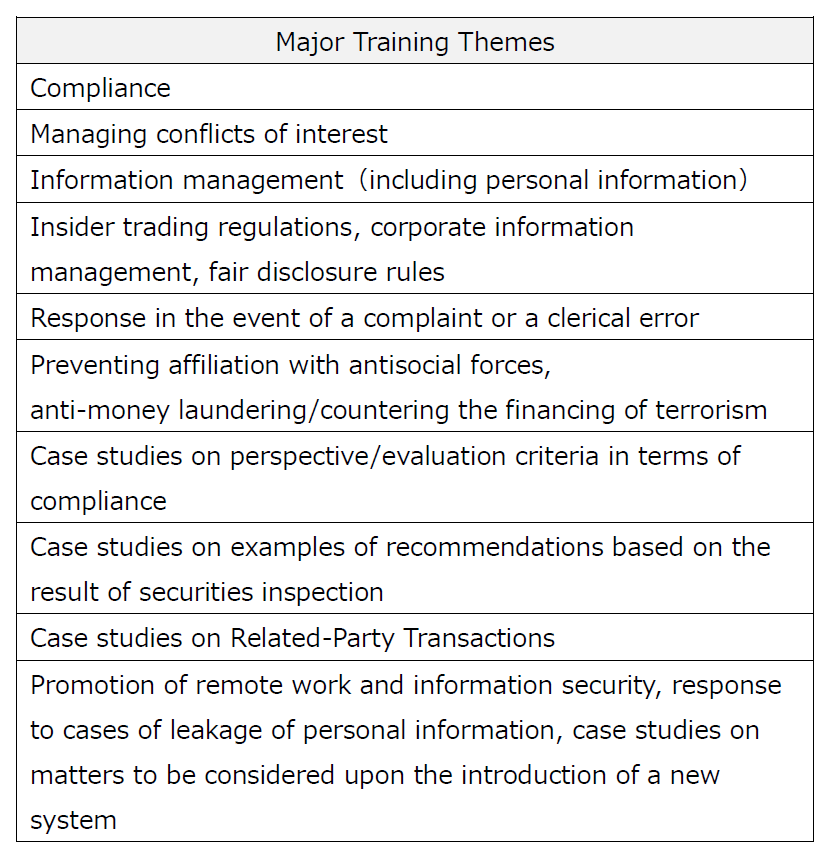

・Internal Compliance Training

To ensure the effectiveness of ethics and laws, market rules (including global regulations that apply to Tokyu REIM), internal rules, etc., internal training is conducted as appropriate, through which the company strives to enhance and strengthen its approach to compliance, foster compliance awareness among officers and employees, etc.

Please refer to this page, about other matters related to compliance training.

Compliance training(2023)

Compliance training(2023)

・Compliance Consultation Desk

With the aim of supplementing its compliance approach, Tokyu REIM strives to proactively prevent behavior that violates compliance, take measures to rapidly address violations, and prevent their recurrence, including the establishment of a compliance consultation desk and harassment consultation desk in accordance with the Whistleblower Protection Act (Act No. 122 of 2004, as well as subsequent amendments). All officers and employees (including temporary employees) and retirees may consult an internal or external (sponsor, external lawyer) compliance consultation desk or harassment desk about matters such as conduct that violates compliance. To protect consulting parties, the “Compliance Rules” stipulate that anonymous reporting is allowed, that they shall not be subject to dismissal or other unfavorable treatment, and that appropriate measures shall be taken to ensure that the consulting party’s work environment does not become worse due to consulting the consultation desk.

<Number of Reports/Consultations Received by Compliance Consultation Desk>

|

|

FY2020 |

FY2021 |

FY2022 |

|

Tokyu REIM |

0 |

0 |

0 |

|

Tokyu Corporation Helpline※ |

294 |

260 |

341 |

※Tokyu Corporation Helpline

With the aim of rapidly detecting and correcting compliance issues, including fraud and scandals, the sponsor Tokyu Corporation has established an internal whistleblowing contact point, the “Tokyu Corporation Helpline,” and promotes awareness of it. Along with an internal contact point, the “Tokyu Corporation Helpline” offers contact points such as a law firm, which handle reports and consultations from Tokyu Group employees (including suppliers), etc.

<Number of Cases Received by Harassment Consultation Desk (Including External Contact Points)>

|

|

FY2020 |

FY2021 |

FY2022 |

|

Tokyu REIM |

0 |

0 |

0 |

・Compliance Checks

The Chief Compliance Officer (CCO) and Compliance Office verify the status of compliance with the law, internal rules, etc. in the execution of business and, in the execution of daily business, also perform compliance checks when transactions of various kinds are conducted, including when TOKYU REIT conducts a transaction with a party related to Tokyu REIM, when formulating and revising internal rules, etc.

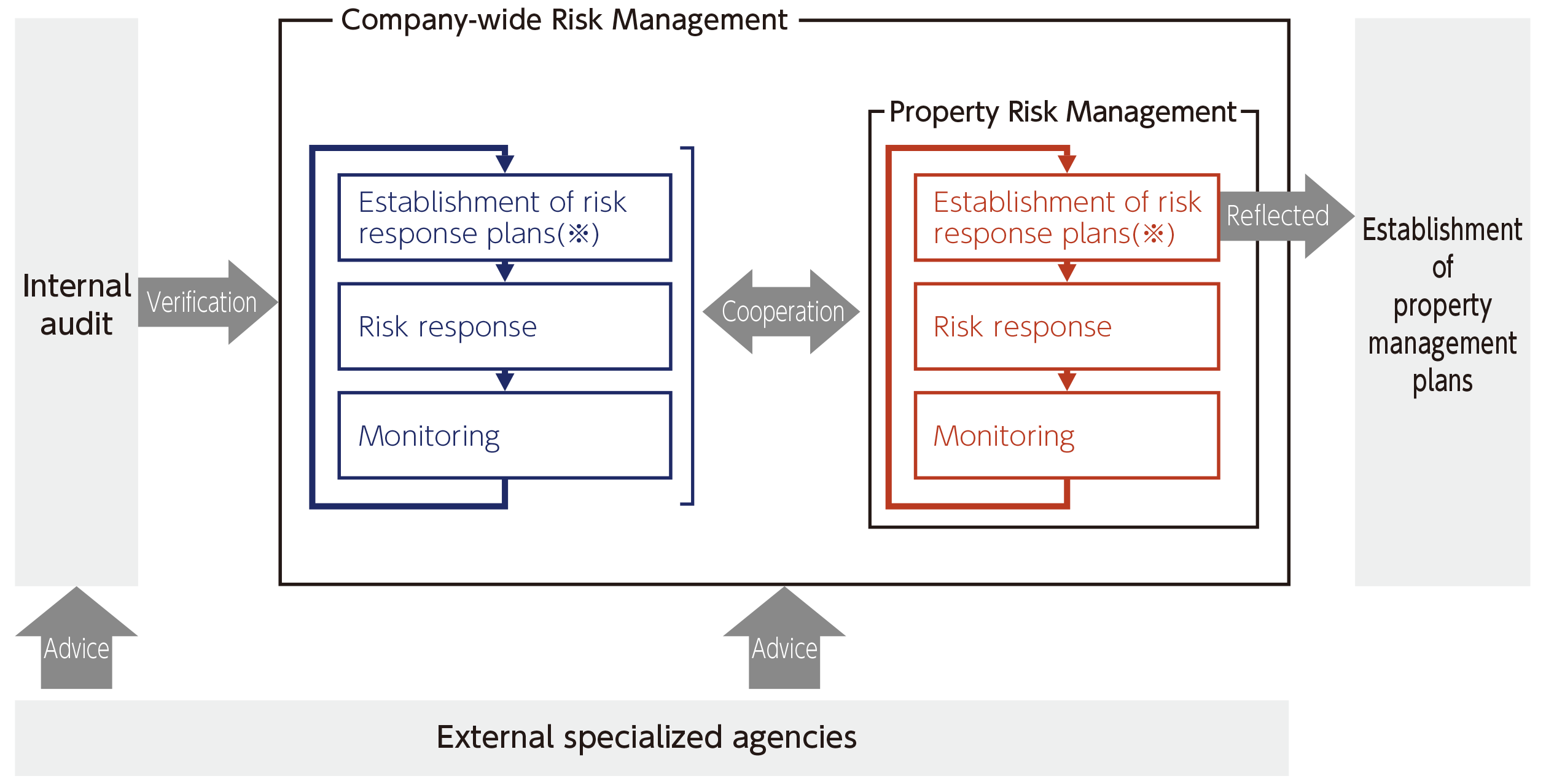

◆Risk Management

In order to maintain and maximize TOKYU REIT’s unitholder value, Tokyu REIM recognizes that it is essential to accurately identify various internal and external risks related to management of TOKYU REIT’s assets and manage those risks using methods that are reasonable and optimal from a company-wide perspective. It has therefore established a “Basic Policy for Risk Management” and “Risk Management Rules” that it implements.

- “Three Lines of Defense” in Risk Management

We appropriately manage risk through an operational structure based on the concept of “Three Lines of Defense.”

| 1st line | 2nd line | 3rd line |

| Self-assessment of control | Monitoring of risk management | Internal auditing |

|

・This line has primary responsibility for the risks inherent in the operations under its jurisdiction. |

・This line establishes and improves a risk management framework. |

・This line maintains independence and objectivity from the 1st and 2nd lines, and verifies and evaluates their activities. |

- Annual Risk Management Cycle

(※)Procedure for establishing risk response plans

|

Company-wide risk management |

Property risk management |

|||||||||||||||||||

|

①Clarify risks based on environmental change analysis and risk definitions |

①Set up of 36 risk items based on economic factors, physical factors, legal factors and other factors |

|||||||||||||||||||

|

②Assess specific risks from a viewpoint of the degree of impact and probability |

②Assess specific risks from a viewpoint of the degree of impact and probability for each property |

|||||||||||||||||||

|

③Assess risk management status |

③Measure the degree of risk containment as of the base date and assess the residual risks on a three-point scale for the above specific risks |

|||||||||||||||||||

|

④Assess residual risks |

||||||||||||||||||||

|

⑤Determine risks to address and their priority |

④Establish risk response plans based on the actual responses made in the previous fiscal year and newly identified risks |

|||||||||||||||||||

|

⑥Finalize response policies for the above risks |

||||||||||||||||||||

- Crisis Management

Recognizing that occurrence of natural disasters, accidents, and other risks has a material impact on its business operation and execution of management of TOKYU REIT’s assets due to economic loss, loss of credibility, significant obstacles in business operation, etc. caused by such risks, Tokyu REIM has established and operates its own “Basic Policy for Crisis Management” and “Crisis Management Rules” to minimize damage upon occurrence of risks and continuously fulfill its social responsibility and public mission as a company.

<Examples of Initiatives>

・Establishment of Crisis Management Committee

・Establishment of BCP and preparation of crisis management manual

・Preparation of stockpile, medicine, etc.

・Execution of large-scale earthquake drills, safety confirmation drills, crisis management headquarters drills and basic first aid drills

Crisis management headquarters drill (2023)

Basic first aid drill (2023)

Tokyu REIM’s Various Compliance and Risk Management-Related Initiatives

◆Major initiatives

- Response to Insider Trading Regulations

Tokyu REIM has established “Rules for Prevention of Insider Trading, Etc.” and builds and operates systems to prevent insider trading through proper management of information on corporations and such.

- Prevention of Money Laundering and Terrorist Financing

Recognizing that countermeasures against money laundering and terrorist financing are one of the most important management issues, we have established a "Basic Policy on Countermeasures against Money Laundering and Terrorist Financing" and are building an internal organizational structure and management structure for our contractors and business partners.

- Information Security

Tokyu REIM has established and operates its own “Basic Policy on Information Security” to ensure protection of information assets and their proper use.

<Examples of Initiatives>

・Establishment of an appropriate structure for system risk management

・Development of safety measures to deter/prevent unauthorized access, unauthorized acquisition of information, information leakage, etc.

- Complaint System

Based on the financial sector's alternative dispute resolution system, we have a system in place for the resolution of complaints and disputes.

-

Coping with Seismic Disasters

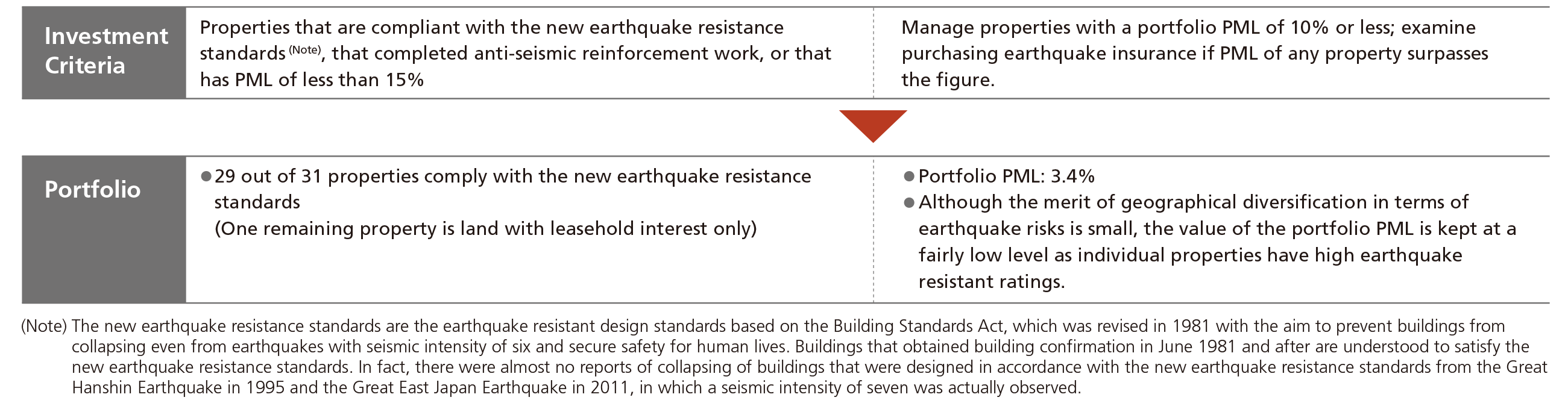

With the aim of developing a portfolio that is resilient to earthquakes, as a criterion for investing in individual properties, TOKYU REIT requires as a rule that they comply with new earthquake resistance standards (Note) and that the buildings have either completed anti-seismic reinforcement work or have a PML of less than 15%. Furthermore, it manages the portfolio so that the PML is 10% or less, and if this figure is exceeded, it will consider obtaining earthquake insurance.

Structural status (earthquake resistance)(as of the end of Jul. 2023)

-

Measures to Prevent Bribery and Corruption

The “Work Regulations” and “Tokyu REIM Compliance Manual” stipulate that the company shall not engage in actions such as providing gifts and entertainment, gambling, etc. and that in the event of illicit or improper money or goods being given or received in relation to its business, the perpetrator shall be subject to strict disciplinary measures.

Furthermore, the Tokyu Group takes steps to prevent corruption based on the Tokyu Group Compliance Guidelines and individual companies’ codes of conduct. In May 2022, the sponsor Tokyu Corporation also established an “Anti-Corruption Policy” that applies to the company and its consolidated subsidiaries. This stipulates that “corruption” which abuses the professional authority or position of oneself or a third party, including bribery (Note 1), conflicts of interest (Note 2), embezzlement, extortion of favors, and bid-rigging, is strictly prohibited and that corruption related to suppliers, etc. of Tokyu Corporation and its consolidated subsidiaries will not be tolerated.(Note 1)Refers to the provision or receipt of gifts, loans, rewards, remuneration, or other benefits from any person whomsoever that goes beyond the scope of laws, regulations, or social norms for the purpose of inducing actions that are unauthorized, illegal, or a breach of trust while carrying out business. So-called “facilitation payments” are also not allowed, regardless of the amount, if they are in violation of laws, regulations, etc.

(Note 2)Refers to a person affiliated with the relevant company (officer, employee, etc.) acting privately and inappropriately to advance their personal interests in a manner that conflicts with the company’s interests.

Please refer to this page, about Tokyu Corporation’s Anti-Corruption Policy.

-

Prohibiting Transactions with Antisocial Forces

Tokyu REIM recognizes that blocking and eliminating all relations with antisocial forces is essential to fulfilling its social responsibility and public mission as a financial instruments business operator and real estate broker. It has therefore formulated a Basic Policies against Antisocial Forces. As part of its efforts, it screens potential transaction partners beforehand for relations with antisocial forces. In addition to this, once a year, it conducts an antisocial forces monitoring survey of suppliers.

Furthermore, it aims to promote thorough awareness among all officers and employees by covering methods of dealing with antisocial forces in compliance training targeting them, etc.

|

Basic Policies against Antisocial Forces Issue Date: August 29, 2013 Tokyu REIM recognizes that blocking and eliminating all relations with antisocial forces is essential to fulfill our social responsibilities and public mission as a financial instruments business operator and real estate broker, and has established the following basic policy on antisocial forces. 1.Response during Normal Circumstances (1) Block and eliminate all relationships with antisocial forces, including business transactions (2) Cooperation with external specialized institutions 2. Response in Emergencies (1) Reject unreasonable demands by antisocial forces (2) Prohibition of backroom deals and provision of funds (3) Organizational response (4) Legal countermeasures

|

◆Surveying Status of Compliance Initiatives at Outsourcing Contractors

To survey the state of compliance initiatives at outsourcing contractors of TOKYU REIT, surveys about the following items are conducted with major outsourcing contractors on a regular basis, with the aim of supervising their activities.

|

<Major Survey Details> |