Adapting to Climate Change

Environmental issues such as climate change are starting to have a major impact on the natural environment and social structure, and the risk of TOKYU REIT’s portfolio being impacted by climate change is expected to increase in the future. Tokyu REIM’s Sustainability Policy states that it will pursue the transition to a decarbonized society through initiatives that promote energy saving and the use of renewable energy and environmentally conscious initiatives such as adapting to climate change. TOKYU REIT and Tokyu REIM will also strive to improve the portfolio’s property value and strengthen its competitiveness by grasping opportunities that exist in tandem with climate change risks.

Tokyu REIM expressed its support for the Task Force on Climate-related Financial Disclosures (TCFD) recommendations in August 2022 and joined the TCFD Consortium, an organization formed by domestic companies supporting the TCFD recommendations.

The Task Force on Climate-related Financial Disclosures (TCFD) is an organization established by the Financial Stability Board (FSB) for the purpose of discussing climate-related information disclosure and the response by financial institutions at the request of the G20. The TCFD releases recommendations to understand and disclose “governance,” “strategies,” “risk management” and “indicators and targets” regarding the risks and opportunities related to climate change.

Based on its Sustainability Policy, Tokyu REIM has established a Sustainability Promotion Committee as part of the structure it has developed to continuously promote and discuss sustainability-related initiatives (including adapting to climate change; the same applies hereinafter) at the organizational level. With the purpose of further strengthening its internal structure, in February 2023 it also established Basic Sustainability Regulations, based on which it pursues various sustainability-related measures under the following structure.

<Sustainability Promotion Structure>

| Body | Main Role |

| Board of Directors | Establishes the Sustainability Policy, receives regular reports on the status of sustainability-related initiatives from the Chief Sustainability Officer, etc., makes necessary decisions, and monitors the status of sustainability-related activities. |

|

Chief Sustainability Officer |

Recognizing that sustainability is a priority issue in management, allocates management resources as appropriate. |

| Chief Sustainability Manager (Chief Financial Officer) |

Supervises Tokyu REIM’s sustainability-related matters and assists the Chief Sustainability Officer. |

| Sustainability Promotion Committee | Based on the Sustainability Policy, carries out discussion, consideration, and reporting for the purpose of continuously pursuing sustainability-related initiatives at the organizational level. |

Please refer to this page, about the sustainability promotion structure.

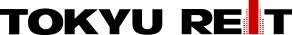

<Diagram of Sustainability Promotion Based on PDCA Cycle>

With respect to the impact that climate change will have on TOKYU REIT, Tokyu REIM has conducted analysis based on multiple scenarios (less than 1.5℃・less than 2℃ scenario and 4℃ scenario) in accordance with the TCFD’s recommendations and identified and assessed the impact that climate change risks and opportunities will have on its business activities.

◆Applicable scope of scenario analysis

The scenario analysis was conducted with ownership and operation of assets in TOKYU REIT’s value chain as the main scope of analysis, with consideration also given to the impact on asset acquisition/disposition and financing.

◆Global Outlook

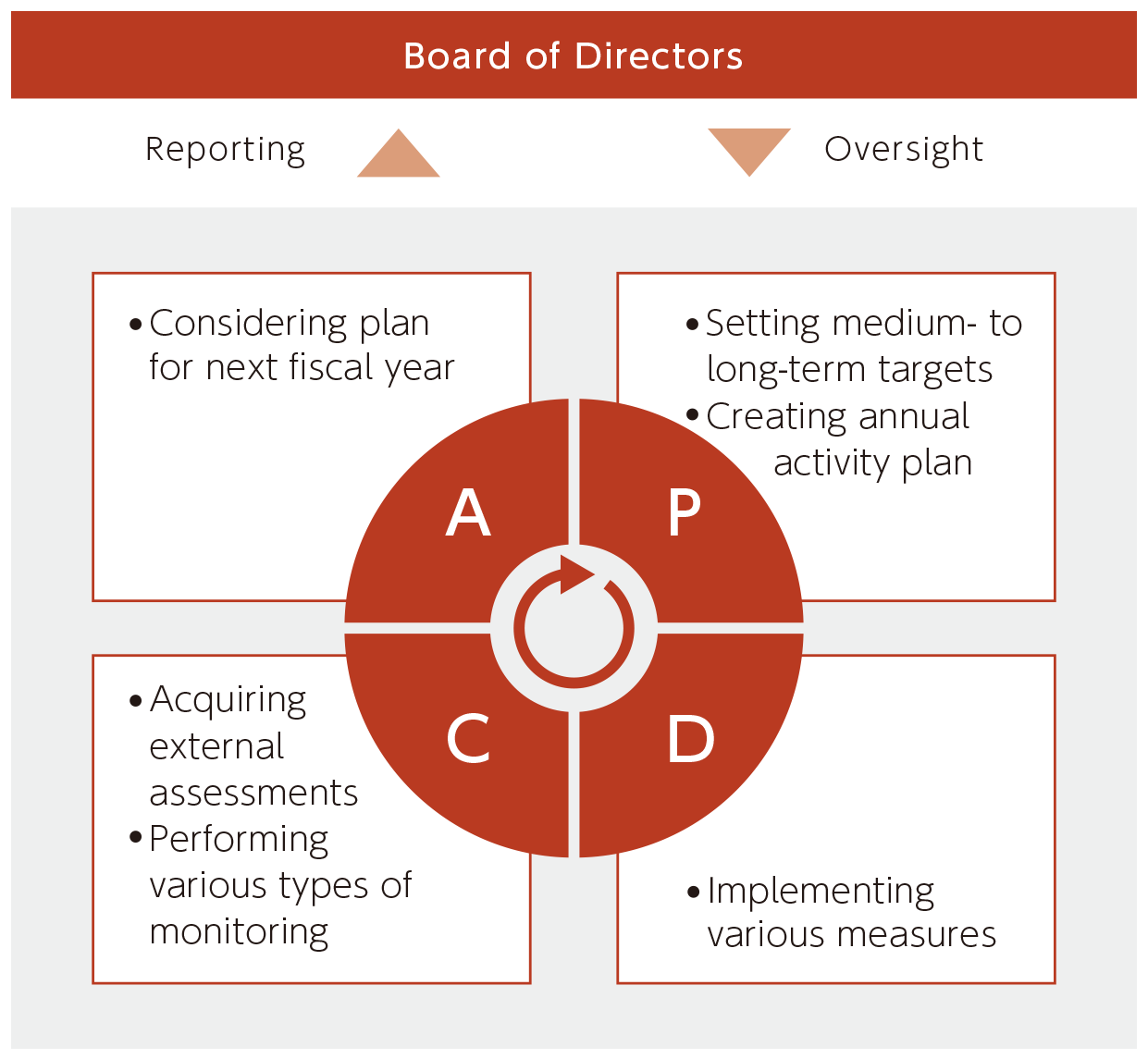

- Global outlook in less than 1.5℃・less than 2℃ scenario

The less than 1.5℃・less than 2℃ scenario assumes that, due to the introduction of strict policies and regulations aimed at realizing a decarbonized society, carbon-reducing technology will develop, greenhouse gas emissions will decrease, and the world as a whole will suppress the scope of the temperature increase since the pre-industrial era to a certain extent. As a result, physical risks will remain low compared with the 4℃ scenario, but transition risks will be higher due to changes in the social structure.

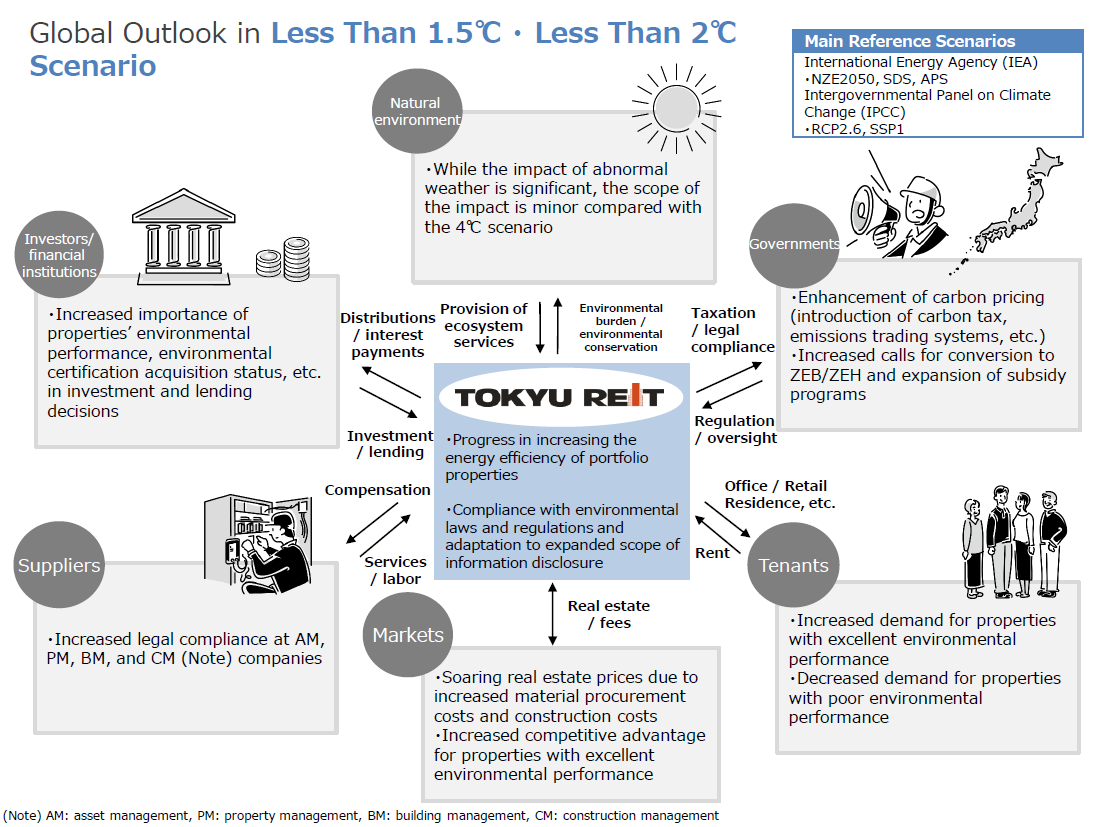

- Global outlook in 4℃ scenario

The scenario assumes that the introduction of the policies and regulations aimed at realizing a decarbonized society will be delayed and it will not be possible to suppress greenhouse gas emissions. The worldwide temperature will therefore increase by around 4℃ from the pre-industrial era. As a result, transition risks will remain low compared with the less than 1.5℃・less than 2℃ scenario, but physical risks will be higher, such as increased abnormal weather due to the impact of climate change.

◆Main climate change risks and opportunities

Tokyu REIM has identified climate change risks and opportunities that will impact TOKYU REIT’s portfolio and conducted an assessment based on the scenarios in which various risks and opportunities would have the maximum impact. It assessed various risks, opportunities, and their degree of impact, based on the less than 1.5℃・less than 2℃ scenario for transition risks and opportunities and on the 4℃ scenario for physical risks and opportunities, and considered countermeasures.

| Risk/ Opportunity |

Impact on Business |

Degree of Impact |

Countermeasures | |||

| 20 30 |

20 50 |

|||||

|

Transition risks |

Policy/ |

Introduction of carbon taxation/enhancement of emissions trading systems |

・Increased financial burden due to tighter greenhouse gas emission regulations based on carbon pricing, etc. | Medium | Medium | ・Ongoing introduction of 100% renewable energy-based power ・Planned reduction of energy consumption aimed at reaching targets |

| Strengthening/expansion of legal systems, energy efficiency assessment labeling systems, and disclosure requirements |

・Increased adaptation burden as information disclosure requirements are strengthened and expanded. ・Increased financial burden due to growing demand to acquire environmental certifications for existing properties and increased acquisition of environmental certifications for portfolio properties. |

Small | Small |

・Planned certification acquisition aimed at reaching environmental certification acquisition rate target ・Replacing assets with properties that have acquired environmental certification and acquiring new ones |

||

|

Increased retrofitting costs (increased renovation costs to comply with greenhouse gas emission regulations) |

・Incurring renovation costs for ZEB and ZEH conversion of existing properties in response to stricter laws and changing customer demands. | Large | Large |

・Promoting ZEB/ZEH conversion work |

||

| Market | Soaring energy prices | ・Rising energy costs due to soaring electricity prices, natural gas prices, etc. | Large | Large |

・Reducing energy consumption by implementing energy-saving-related work |

|

| Changes in customer demand |

・More competitive acquisition environment due to growing demand for properties with excellent environmental performance, soaring property acquisition prices, etc. ・Lower competitiveness as demand for portfolio properties with inferior environmental performance decreases. |

Large | Large |

・Planned certification acquisition aimed at reaching environmental certification acquisition rate target |

||

| Reputation | Changes in investors’ and financial institutions’ attitude and evaluations |

・Changes in investors’ and financial institutions’ attitudes to ESG lending and investment and company assessments. |

Medium | Medium–Large |

・Proactive use of sustainable financing |

|

| Physical risks |

Acute | Increase in abnormal weather |

・Decreased asset value for properties at high risk from natural disasters due to increases in abnormal weather. |

Small | Small |

・Identifying risks based on hazard maps, etc. |

| Chronic | Impact of increased average temperatures | ・Increased cooling costs for properties due to abnormally high temperatures. ・Incurring renovation costs due to sea level rise, etc. (regrading, etc.) |

Small | Small |

・Reducing energy consumption by implementing energy-saving-related work |

|

| Opportunities |

Energy sources |

Reduced expenses due to spread of renewable energy |

・Reduced procurement costs as renewable energy supply volume increases due to growing demand for decarbonization. ・Reduced energy costs due to energy saving and energy creation. |

Medium |

Medium–Large |

・Ongoing introduction of 100% renewable energy-based power |

| Products/ services |

Increased demand for green buildings | ・Increased rental income and occupancy rates for properties with excellent environmental performance due to changing customer demand. | Large | Large |

・Planned certification acquisition aimed at reaching environmental certification acquisition rate target |

|

| Market | Improved reputation for ESG investment and reduction in financing costs due to sustainable financing |

・Improved ESG reputation due to proactive implementation of ESG- and climate change-related initiatives and expanded information disclosure, leading to increased stakeholder preference. ・Expansion of financing base through expansion of investor and financial institution pool due to use of sustainable finance, which may be expected to reduce financing costs. |

Medium | Medium–Large | ・Proactive use of sustainable finance ・Promoting ESG and climate change adaptation; enhancing disclosure details ・Promoting initiatives aimed at improving ESG assessments by external organizations |

|

| Resilience | Improved reputation for properties with excellent resilience | ・Increased rental income and occupancy rates due to positive evaluation of competitive advantage of properties with excellent disaster resilience. | Small | Medium | ・Identifying risks based on hazard maps, etc. ・Reducing disaster risks by installing waterproof boards and emergency power sources, implementing BCP measures, etc. ・Providing disaster prevention information to tenants ・Promoting adaptation aimed at improving resilience; enhancing disclosure details |

|

◆Analysis results and future adaptation

Based on the results of this scenario analysis, we will maintain and enhance our promotion of initiatives that contribute to reducing our environmental burden and enhancing our disaster resilience, as well as strive to reduce risks and maximize opportunities by refining the scenario analysis and revising adaptation measures in order to further reinforce the resilience of our business.

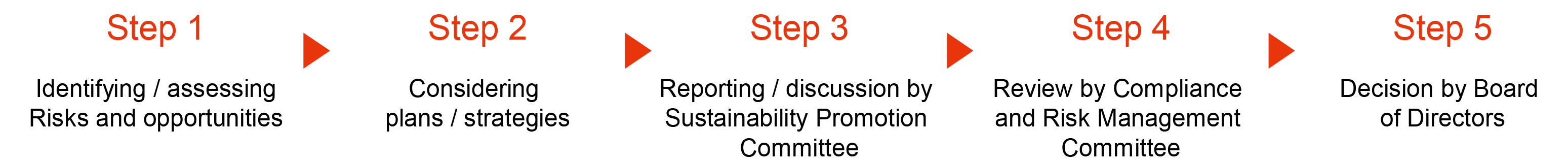

◆Identifying and assessing risks

Risks and opportunities caused by climate change, the degree of their impact on the portfolio, and the probability of their occurrence are identified and assessed through the process below.

<Risk Identification and Assessment Process>

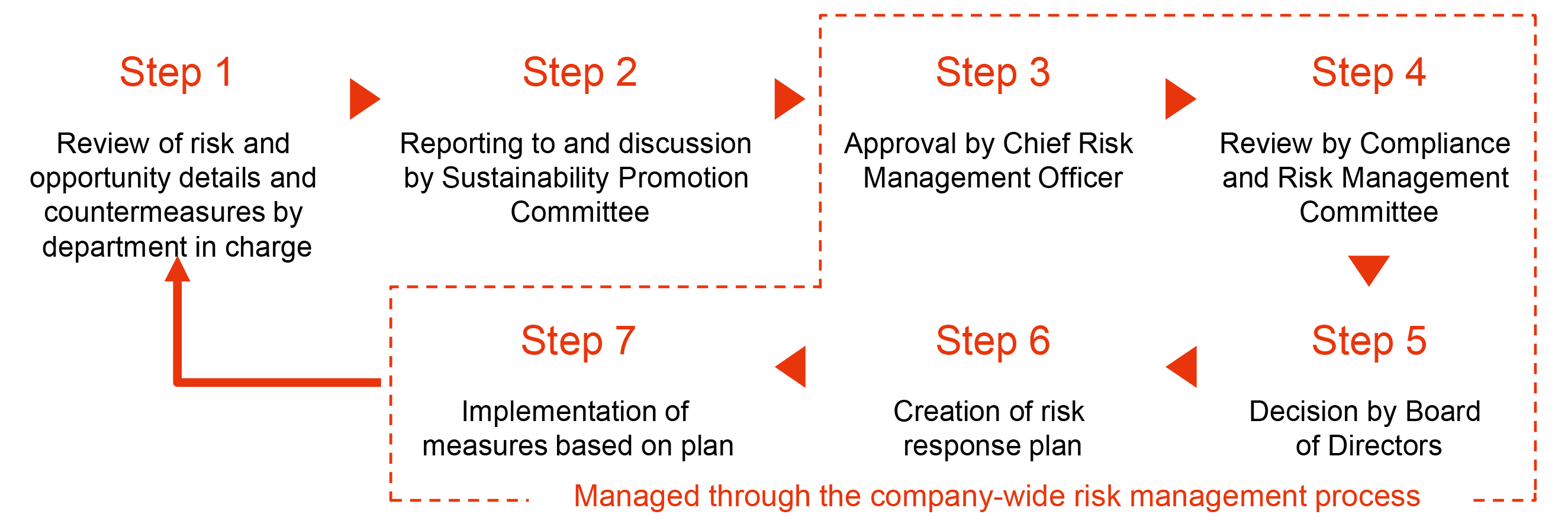

◆Integration of risk management and company-wide risk management process

The details of climate change risks and opportunities that have been identified and assessed and countermeasures are reviewed once a year and reported to and discussed by the Sustainability Promotion Committee. Furthermore, these details are integrated into the company-wide risk management process and managed within the risk management cycle based on the "Risk Management Basic Policy" and "Risk Management Rules".

<Risk Management Process>

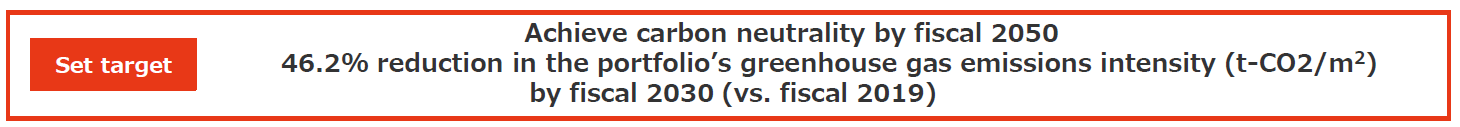

With the purpose of reducing climate change-based risks and improving medium- to long-term asset value, Tokyu REIM has set the following targets when managing TOKYU REIT’s assets, and it aims to improve environmental performance by implementing initiatives and carrying out monitoring.

◆Greenhouse gas emissions

- Set target

*The reduction targets apply to Scope 1, 2, and 3 (Scope 1 = consumption of city gas in common areas; Scope 2 = consumption of electricity, hot and cold water, and steam in common areas, Scope 3 = consumption of electricity, hot and cold water, and city gas in private areas and through direct contracts with tenants.

*Equity conversion was performed for properties owned on a co-ownership or sectional ownership basis.

Please refer to this page, about environmental performance data (greenhouse gas emission status).

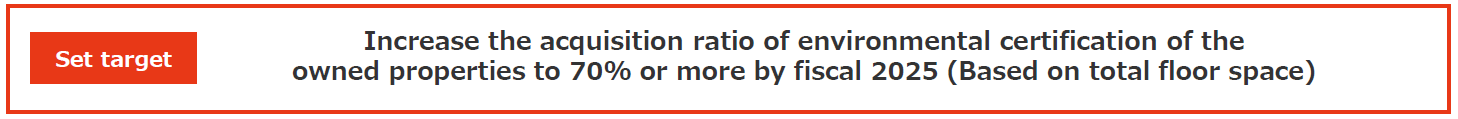

◆Green Building

- Set target

Please refer to this page, about properties that have acquired various environmental certifications.